Church Mortgage Loans

We offer first mortgage loans with competitive interest rates and flexible terms tailored to meet your church’s needs. We work with you to ensure that financing accommodates your current and future plans. We’ll listen to your needs and concerns, and we’ll take the time to interpret our loan plans to church leaders, to help you determine which plan is most advantageous.

Churches or organizations with Foundation investment funds may also qualify for a securities loan through us. Contact 608-837-9582 or wumf@wumf.org for an accounts review.

If you wish to have your monthly loan payment automatically withdrawn from your church bank account each month, please send us a completed authorization form for ACH debits.

Loanable funds are provided by church, agency, and conference accounts that are invested in the Foundation’s “Loan Pooled Fund”. These organizations serve in mission partnership with borrowers by investing their available funds in the “Loan Pooled Fund”. This stewardship of church resources is key to the success of the Foundation’s Loan Program.

To qualify for a Foundation loan, churches must meet the Foundation’s underwriting criteria. Payment of Conference Apportionments is a factor that will be reviewed as part of our underwriting process.

Loan Options

• Construction Loans

If you are planning to build a new church, planning an addition, remodeling, or extensive repair and improvements, you will want to consider our Construction Loans. During construction, you pay interest only on funds as drawn. After construction is complete, your loan will automatically convert to a permanent fixed rate or adjustable rate mortgage loan. Churches must follow Conference procedures regarding building projects and must secure all necessary approvals.

• Refinance Loans

If your church currently has a mortgage loan, we would like to review with you the benefits of refinancing with the Foundation. With our low rates and minimal costs, we may be able to save you money.

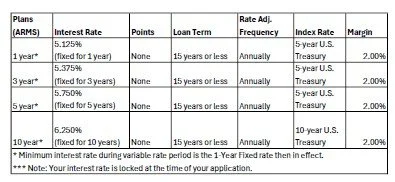

• Adjustable Rate Loans

We currently offer Adjustable Rate Loans with terms up to fifteen years. The interest rate on these loans is initially fixed for a term of one, three, five or ten years to suit your church’s needs. After this period, the interest rate is adjusted annually. These loans are secured with either a first mortgage on church property or with an unrestricted investment account held at the Foundation.

Mortgage Loan Rates

Weekly Rates for time period: Feb. 3, 2026 – Feb. 10, 2026 ***

Frequently Asked Questions

Can any Wisconsin Conference United Methodist Congregation apply for a first mortgage loan from the Loan Pooled Fund?

Yes, however to qualify for a mortgage commitment, the congregation must complete a thorough and rigorous application and underwriting process. In general, the church must demonstrate a past record of stewardship and church finances which will allow the church to service this new mortgage debt without jeopardizing the vitality and support of the ongoing church ministry and mission program. Payment of Conference Apportionments is a factor that is reviewed as part of our underwriting process.

Churches must pass a rigorous application and underwriting process, including approval of the building project(s) by the District Committee on Building and Locations, signed letters of approval by the District Superintendent and Church Pastor, passing of the Wisconsin United Methodist Foundation Cash Flow Model indicating the Church is able to service the mortgage debt without jeopardizing its ongoing program of ministry and mission, and final approval by the Wisconsin United Methodist Foundation Loan Committee.

What will be the rate of interest charged on these mortgages?

The lowest rate will be offered to churches requesting an Adjustable Rate Mortgage with the interest rate moving in relationship to a defined index. Churches wishing to fix their interest rate for three to ten years will pay a slightly higher rate of interest, as determined by the Wisconsin United Methodist Foundation Loan Committee, which would be adjusted only at the end of the three-year, five-year or ten-year fixed rate period. There would be a minimum floor rate and maximum ceiling rate that could be charged during the term of the mortgage agreement. Churches must pass a rigorous application and underwriting process, including approval of the building project(s) by the District Committee on Building and Locations, signed letters of approval by the District Superintendent and Church Pastor, passing of the Wisconsin United Methodist Foundation Cash Flow Model indicating the Church is able to service the mortgage debt without jeopardizing its ongoing program of ministry and mission, and final approval by the Wisconsin United Methodist Foundation Loan Committee.

What will happen in a church begins to experience difficulty in keeping current on its mortgage payments?

The Wisconsin UM Foundation will continuously watch the performance of all outstanding mortgages. If we notice that a church is beginning to experience difficulties in their repayment, the Foundation will provide stewardship assistance and guidance to help the church regain sound stewardship patterns. Unlike a commercial lender, the Foundation’s primary goal is to help a church grow in ministry and maximize its available resources. We expect every church to successfully repay their church loan. Remember, the available loan funds belong to other churches or to the Foundation. We have a fiduciary responsibility to insure those funds are not exposed to undue risk.

Can a church refinance an existing mortgage with a new mortgage at the Wisconsin United Methodist Foundation?

Yes, however, the church would have to complete a thorough application and underwriting process similar to other applicants.